Learn why Raghee says the first 2-hour “morning pattern” is the best time to trade

Day trading is an entirely different ballgame from other timeframes. It offers the potential for the fastest rewards but also a risk of giving back gains through overtrading. In fact, most day traders P&L looks more like a roller coaster rather than a steady climb.

Too many think sitting in front of the screen all day is required to generate consistent returns..

For example, take a look at this NQ trade …

It was during 2 peak hours in the trading day that this trade made $1,900 in profit.

Whether it’s $5K dollar accounts or 5 million dollar accounts, you can now unlock the strategy that makes moves like this one possible, no matter how volatile the market is at any given moment.

This ES trade is a great example of how taking advantage of precise entry points can create a lot of opportunities.

As you can see, anyone who didn’t pull out after 1:30pm regretted it and those who didn’t buy on time missed out.

Look at this chart of Raghee’s P&L and you can see why she loves this strategy…

Using this method, Raghee’s found a way to target strong gains with only minor drawdowns.

Learn Raghee’s scalable method for pulling profits in almost any market.

If there’s an error day traders make over and over again, it’s over trading. Over trading can be costly and lead to unnecessary losses.

Using her trading plan and time-tested tools, Raghee Horner Managing Director of Futures at Simpler Trading, generates astonishing returns trading just two hours a day, a few days a week. What makes her strategy even more unique is that it can work for almost any asset, including futures, ETFs, stocks, and options. The core of Raghee’s method is a predictable “morning pattern” that occurs between 9:30 a.m. and 11:30 a.m. Eastern.

Trading in this short time frame is all it takes for Raghee to reliably rack up substantial gains on a few trades each week.

Her tools and strategy take advantage of the “Clearing Range” to make profitable trades while avoiding costly mistakes.

With her strategic trading plan Raghee is able to identify the precise entry, profit targets, and stop losses before she even places a trade.

She uses her proprietary VWAP Max Indicators to trade in sync with the big institutional players. It’s her secret for avoiding getting stuck in the “wrong moves” and catching some of the best trades in just 120 min a day.

This is how she was able to turn $7.5K into $75K only trading 2 hours, and then scale that strategy the following year to turn $80K into $215K.

In this step-by-step training you’ll discover how to:

VWAP Max Indicators

With every package, you get the proprietary VWAP Max Indicators developed by Raghee Horner and Eric Purdy, Simpler’s Director of Quantitative Strategies. The VWAP tool analyzes price and volume to help traders determine market sentiment with clarity.

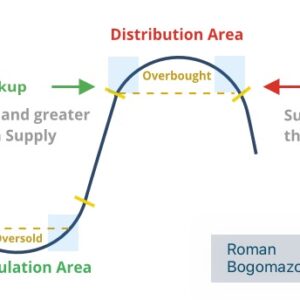

You’ll discover how to use these powerful indicators to quickly identify market sentiment on any chart following Raghee’s step-by-step process. You’ll also learn how to use the VWAP to automate overbought and oversold readings and identify up, down, and choppy market conditions with astonishing clarity.

Darvas Box 2.0

Take automated price action to the next level with the updated Darvas 3.0 indicator. By using color coated arrows, the new Darvis 3.0 signals to traders when price has reached key levels. Now, traders can be alerted when price has attained selected minor low and minor high patterns that Darvas is built upon. These automated arrows will signal turning points and confirmation of high probability levels.

Use these “signal arrows” to identify both entries and exits once they’ve been triggered. The updated Darvis 3.0 support and resistance signals highlight opportunities as the pattern forms. Even better, this updated indicator also signals where there’s a probability of a stall or reversal. Let the arrows point the way to spotting stronger support and resistance levels.

Sales Page:_https://www.simplertrading.com/courses/day-trading-playbook/

Reviews

There are no reviews yet.